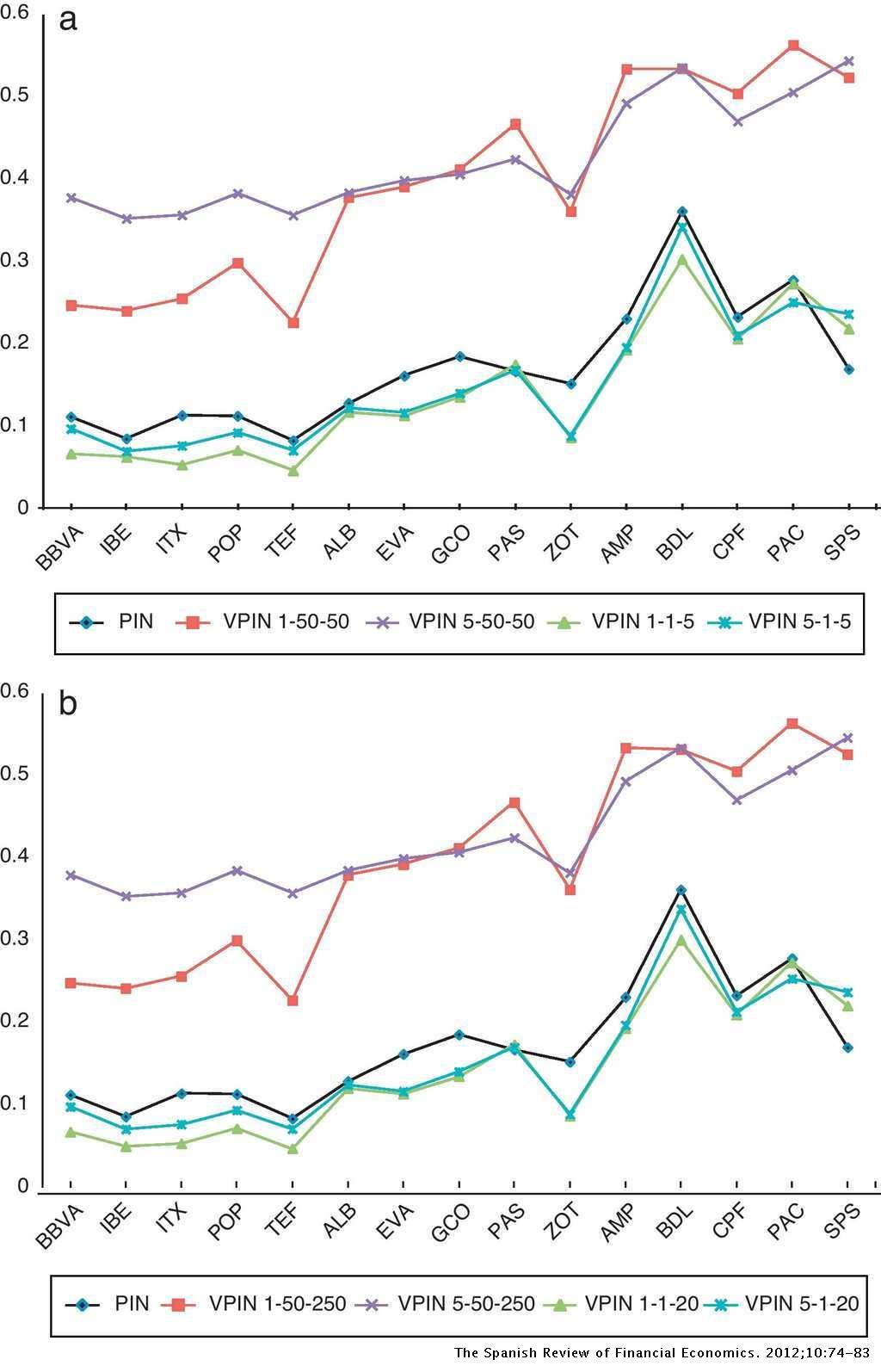

From PIN to VPIN: An introduction to order flow toxicity | The Spanish Review of Financial Economics

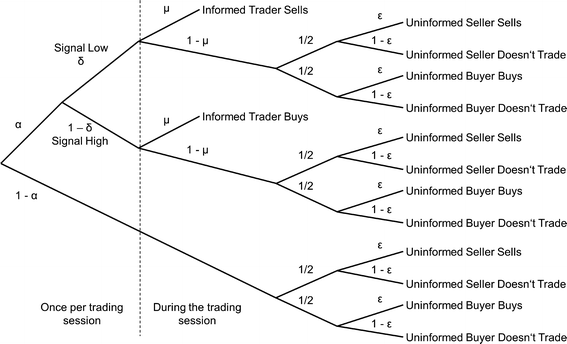

Is Informed Trading Different Across Investor Types?* - Park - 2020 - Asia-Pacific Journal of Financial Studies - Wiley Online Library

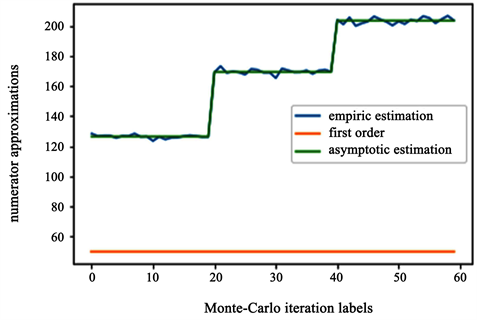

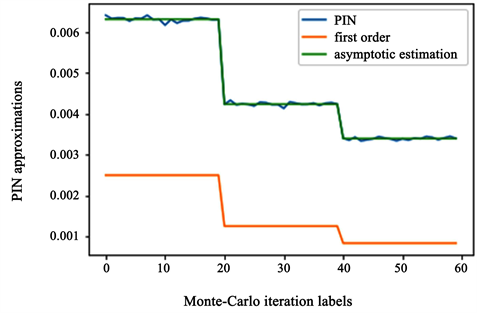

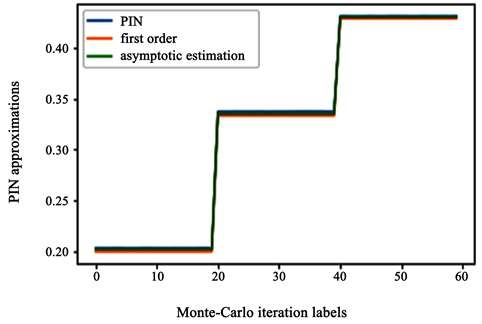

pinbasic: An R Package for Fast and Stable Estimation of Static Models for the Probability of Informed Trading

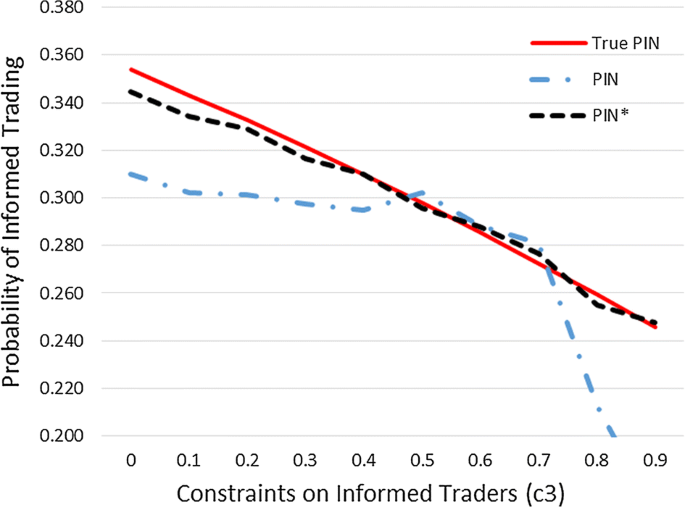

Average probability of informed trading (PIN) measure in the year after... | Download Scientific Diagram

VPIN 1 The Volume Synchronized Probability of INformed Trading, commonly known as VPIN, is a mathematical model used in financia

GitHub - shuangology/Probability-of-Informed-Trading: Implementation of PIN ( Probability of Informed trading) on A-Share daily public data (based on Yan Y, Zhang S. An improved estimation method and empirical properties of the probability

Measuring and Explaining the Probability of Informed Trading and its Relationship with the Cost of Capital with an Emphasis on F

Does PIN measure information? Informed trading effects on returns and liquidity in six emerging markets - ScienceDirect

VPIN 1 The Volume Synchronized Probability of INformed Trading, commonly known as VPIN, is a mathematical model used in financia

pinbasic: An R Package for Fast and Stable Estimation of Static Models for the Probability of Informed Trading

Average probability of informed trading (PIN) measure in the year after... | Download Scientific Diagram